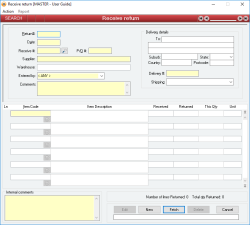

Receive return

A Receive return is the means by which goods form a Purchase Order are returned to a Supplier (Creditor) after initially receiving them through a Receive. A receive return is used to return goods to a supplier where you don’t want to get them back again, such as an incorrect order, over-order or accidental double-up. If you want to return goods to the supplier but you want the correct goods back again (such as returning damaged goods or an incorrect supply), then use a normal Receive record but with negative line quantities: this indicates a reversal of a Receive and will put the items back on backorder. If the lines you are trying to enter as negatives do not show up on the Receive, then click on the button at the bottom right “Show all lines ”. This will cause all lines for the purchase order to be displayed even if they have already been fully received.

It is important to use a Receive return when goods are taken back instead of modifying the original Receive, for the following reasons:

- You have accurate historical information about the date and means of the delivery and return of goods

- The system can ensure that the goods are removed from the warehouse at the same cost as they were received

- You can invoice a Receive return as a credit against the original invoice

The following can also be said about Receive returns:

- A Receive return is performed for some or all of the Items for exactly one Receive

- A Receive return is performed only for the Warehouse that is referenced on the original Receive

- You cannot return more Items for a Receive return line than were delivered on the original Receive

A Receive return cannot be performed where the Receive return date is not within the Extended financial year or where the date is before the Journal lock date.

The Receive return line details form is activated by clicking on the button under the item code field for an order line.

- For each line containing a stock item a RECEIVE Stock transaction is created that reduces the Quantity On Order and increases the Quantity in Stock for the warehouse by the negative of the quantity specified. The total value of the stock decreases and the average cost of the stock item is recalculated to take into account the removed Items. The cost of the item that is used to update the stock average cost may or may not include the tax component depending on whether or not the Tax code for the item specifies that tax is or is not included in the cost of the item.

- For each line in the Receive, a RECEIVE Journal transaction is created that Debits the Asset account specified in the Receive Line details (increases its value) and Credits the Uninvoiced Receivings account specified in the Database Setup (increases its value) by the total negative cost of the Receive line. The cost that is used to update the accounts may or may not include the tax component depending on whether or not the Tax code for the item specifies that tax is or is not included in the cost of the item.

- For each line in the Receive that contained a tax component that was not included in the cost of the item placed into stock, a RECEIVETAX Journal transaction is created that Debits the Tax on Purchases account (defined in the Tax code information for that item) and Credits the Uninvoiced Receivings account specified in the Database Setup by the negative amount of tax for that line.

- You can return fewer Items for a Receive return line than the full quantity originally received

- You can create as many Receive returns as you like for a single Receive

- A Receive return is invoiced in the same way as a normal Receive

- Pop up notifications available for Suppliers and Items

Module: Accounts payable

Category: Receive returns

Activation: Main > Accounts payable > Receive return

Form style: Multiple instance, WYSIWYS, SODA

Special actions available for users with Administrator permissions:

- Alter the User ID in the Entered by field.

- Change the User ID of the Entered by field of memos.

- Edit memos entered by other users.

Database rules:

- A Receive return cannot be given a date that is outside the range of the Extended financial year

- A Receive return cannot be deleted if its date is outside the range of the Extended financial year or before the Journal lock date

- A Receive return cannot be deleted if it is referenced by any of the following:

- Supplier invoices

Reference: Number, Read-only, WYSIWYS

This number uniquely identifies a Receive return. The Return # is automatically generated by the system after the first update of the Receive return and cannot be changed for the life of the record.

If a Receive return is deleted, its Return # will never be used again for another Receive or Receive return.

Because a Receive return is essentially a Receive, the same sequence of identifiers is used for them. This means that you may see missing numbers in the sequence Receive numbers that relate to Receive returns and vice versa.

Reference: Button

This field indicates whether the current Receive return has been fully or partly Invoiced. It will only be visible for Receive returns that have at least one Supplier invoice entered for them.

Clicking on the field will cause a menu to drop down displaying all the Supplier invoices relating to the current Receive return. Clicking on any of the displayed Invoices will then display the selected Supplier invoice record.

Reference: Date, Mandatory, QuickList, WYSIWYS

This is the Receive number for which the Receive return is being performed. Only the goods that were originally received on a Receive can be returned on a Receive return. Once a Receive number has been selected, when you leave the field the original Purchase Order number and the Supplier name is filled in and all available lines for the selected Receive are displayed in the Receive return lines area. To display a list of all valid Receive numbers, click on the button or press the QuickList Hot Key.

Reference: Select from list, HotEdit, WYSIWYS

This is the User name of the user that created the Receive return. This is automatically filled with the User name of the current user and cannot be changed unless the user has Administrator permissions for Dispatch returns.

Reference: Memo, Expandable, WYSIWYS

These are free-text comments that should appear on the printed report for the receive return.

Reference: Address

This is the address to which the goods are being returned.

Reference: Select from list, HotEdit

This is the shipping firm responsible for transporting the goods back to your Supplier.

Reference: Memo, Expandable

These are any internal comments or instructions that are not intended to appear on printed material for external consumption, for internal eyes only.

Reference: Text, Read-only, Expandable

This is the description for the receive line. This is the same description as that which appears on the equivalent Purchase order and Receive line and it cannot be changed from the Receive return form.

Reference: Quantity, Read-only

This is the number of units of items that have already been Returned for this line. If you are viewing a Receive return in Idle mode, this quantity includes the quantity on the current Receive return. Otherwise (if you’re in Add or Edit mode), this quantity does not include the quantity from the current Receive return.

Reference: Quantity

This is the number of units of items being returned for this line. This value cannot be more than the total quantity of Items received for this line.

This is the unit of measure of the item that is being receive-returned. The Return Qty specified is always in terms of this unit, and the number of single items that constitute this unit is displayed below the Unit field (unless that quantity is 1).

The units for the Receive-return line are determined by the Purchase Order line and cannot be changed.

When an item is returned, the number of single Items that are removed from stock is equal to the Return Qty multiplied by the Unit qty.

Reference: Read-only

Information is under review for a new version and will be updated soon.

Reference: Yes/no

Information is under review for a new version and will be updated soon.

Reference: Yes/no

Information is under review for a new version and will be updated soon.

Reference: Account Field Type, QuickList

Information is under review for a new version and will be updated soon.

Reference: Menu

This menu option automatically displays the Supplier Invoice form and creates a new Supplier Invoice for the current Receive return.

The details of the new Supplier Invoice can then be modified manually before it is updated, or it can be cancelled.